Optimize Your Data with Expert Data Management

DullesSystems Data Management Services

-

Data Integration and Migration

Seamlessly connect and migrate data across systems, ensuring consistency and reliability in your data landscape.

-

Master Data Management

Establish a unified view of critical data, enhancing accuracy and operational efficiency.

-

Data Governance and Compliance

Implement robust frameworks to maintain data integrity, security, and adherence to industry standards.

-

Data Transformation and Quality Assurance

Streamline data processes to convert raw data into actionable insights, enabling strategic decision-making.

Transform Your Data into a Strategic Asset

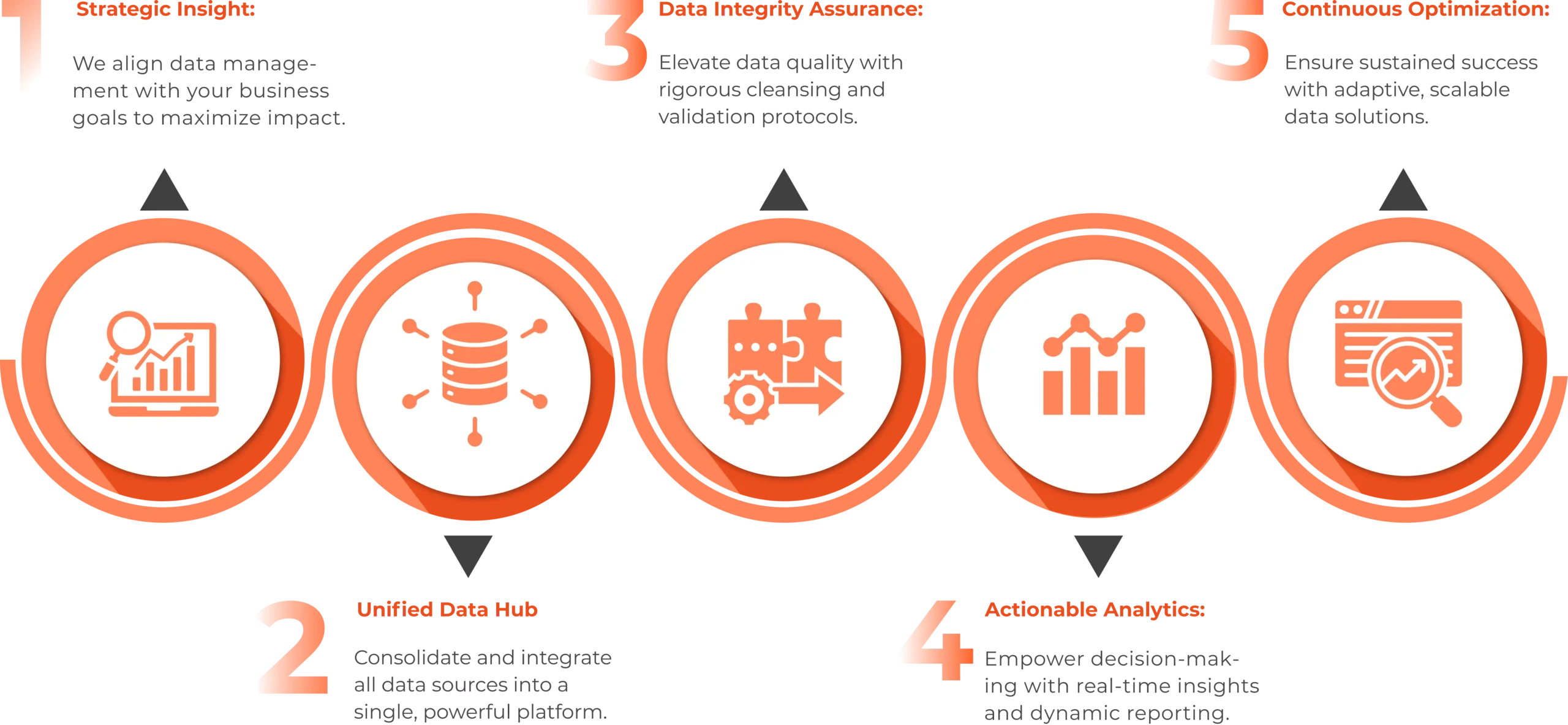

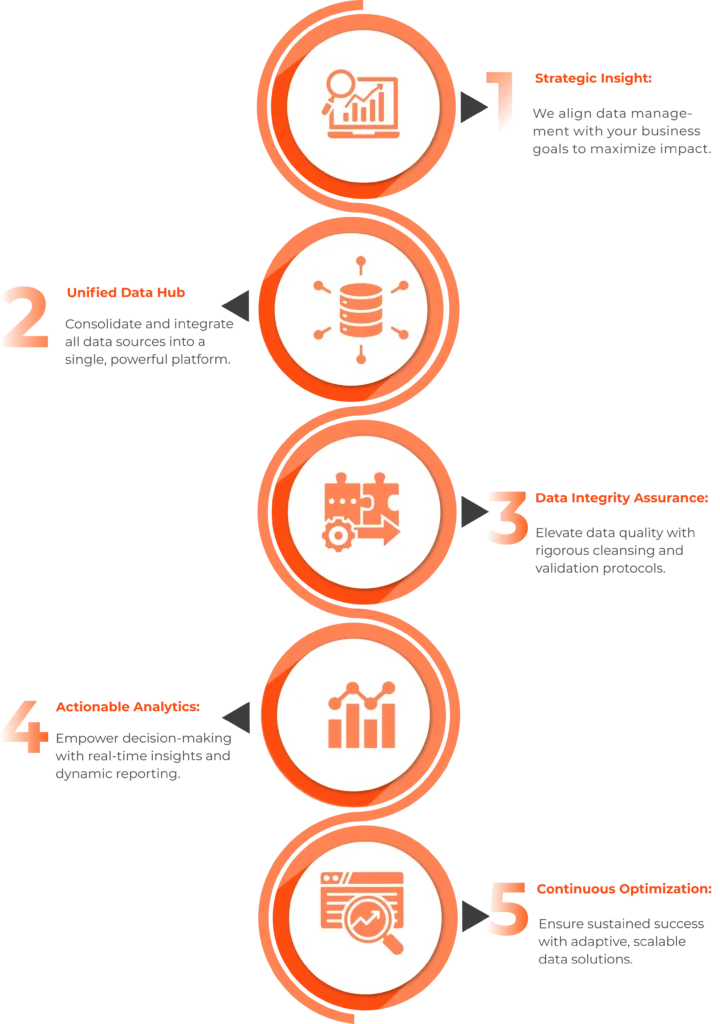

Our Process

Dulles Impact

Strengthening HAMP: Data Management for Compliance and Efficiency

Data management is the backbone of any successful organization, serving as the foundation for informed decision-making and efficient operations. It involves the systematic process of collecting, organizing, storing, and maintaining data in a way that ensures its accuracy, consistency, and security throughout its lifecycle.

Strengthening HAMP: Data Management for Compliance and Efficiency

Our client

The Home Affordable Modification Program (HAMP) was established with a critical mission: to assist homeowners at risk of foreclosure by offering them reduced monthly mortgage payments that are both affordable and sustainable over the long term. This initiative was created to support families grappling with financial difficulties by adjusting their mortgage terms. To be eligible for HAMP, homeowners must demonstrate documented financial hardship and prove their ability to manage their mortgage payments after receiving a modification.

HAMP operates as a voluntary program that enables mortgage servicers to modify loan terms to prevent foreclosure while protecting taxpayer interests through a pay-for-success model. This model ensures that funds are allocated only when transactions are completed successfully and remain in place as long as contractual obligations are met, with disbursements stretching over many years.

The program has proven effective in encouraging mortgage servicers to lower monthly payments for qualifying homeowners. Participants in HAMP typically experience a significant reduction in their monthly payments, with a median decrease of more than $530. Beyond these direct savings, HAMP has also motivated private lenders to offer modifications without additional costs to taxpayers. The program has set industry-wide standards for affordable mortgage modifications, enhancing the overall approach to mortgage assistance and making private loan modifications more accessible.

Through HAMP, nearly 5 million Americans have received vital mortgage assistance, helping them avoid unnecessary foreclosures. The Making Home Affordable (MHA) program, which oversees HAMP, ensures that servicers fairly evaluate homeowners and adhere to program guidelines through thorough compliance reviews. The Treasury mandates that servicers continually improve their processes to effectively support homeowners in need, focusing on ongoing compliance and program effectiveness.

Challenges Faced

- Massive Servicer Noncompliance: The HAMP program struggled to reach its goal of assisting 3 to 4 million households due to widespread noncompliance among mortgage servicers. This issue significantly impeded the program’s effectiveness and scale.

- Inefficient Data Handling: Data received from servicers were non-standardized and inconsistent, leading to inefficiencies and errors in processing. The lack of standardized data interfaces resulted in delays and inaccuracies.

- Complex Coordination Needs: The program required coordination with multiple external entities, including loan servicers and legal bodies. Managing these relationships and ensuring timely and accurate resolutions added significant complexity to the program.

DullesSystems’ Solution

- Regulatory Compliance and Requirements Management: DullesSystems ensure regulatory compliance by managing accounting reconciliation and reporting for Treasury, FHFA, FHA, and MHA-C (Freddie Mac). This included implementing controls and procedures to meet regulatory standards.

- Data Standardization and Automation: Standardized data processing and retention procedures to improve consistency. Automated approximately 1,100 reports, reducing manual effort and increasing operational efficiency.

- Comprehensive Data Quality Management: Conducted extensive data quality assessments, including profiling, monitoring, and remediation. Implemented global and targeted outreach efforts for data quality remediation, addressing over 916,000 cases.

- Operational and Compliance Support: Developed and executed controls, process flows, and procedures for operational processes. Supported compliance and audit efforts with accurate data, reports, and evidence.

- Advanced Data Analysis: Performed detailed data analysis, modeling, outlier analysis, and risk and trend analysis to provide actionable insights. Managed the execution and validation of interfaces, reconciliation reports, and metrics.

- Executive Reporting and Strategic Support: Delivered executive reporting on key metrics and scorecards. Provided strategic counsel on business case studies, CAPs, projections, servicing transfers, compensation, and loan corrections.

Please refer to the following diagram for our data management strategies:

Value Added

- Increased Efficiency: Achieved a ~48% reduction in data support validation efforts and a ~56% reduction in execution and interface validation. Automation of ~1,100 reports significantly streamlined operations.

- Enhanced Accuracy: Improved data accuracy and reliability through advanced data analysis and extensive data quality remediation. The reduction in errors and discrepancies led to more reliable reporting and insights.

- Strategic Decision-Making: Enabled informed decision-making with comprehensive data management solutions. Provided critical strategic insights and support, enhancing the effectiveness of program oversight and planning.

- Effective Data Management: Standardized data processing and improved handling of sensitive information. This ensured better compliance, efficient operations, and effective program management.

- Enhanced Reporting and Analysis: Facilitated better visibility and transparency through detailed executive reporting and analytics, supporting improved program oversight and strategic decision-making.